Much like rideshare drivers, delivery drivers should be tracking their mileage in a log and could get a deduction for all business mileage. With the rising popularity of services such as Amazon Flex, DoorDash, Postmates, and UberEATS, delivery drivers are definitely in demand in certain geographic areas. Keep track of your deductible miles. I’ve gotten several…

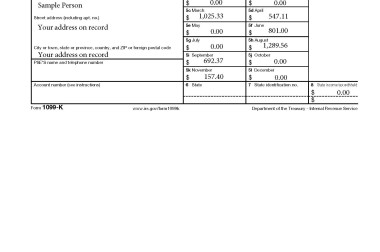

Deductible Miles for a Delivery Driver